Schedule A 940 Form 2024 – The W-4 form is an Employee’s Withholding Allowance Certificate designed to let your employer know how much of your income to withhold for federal taxes. You should fill out a new W-4 when you have . The partner or member uses this form, Schedule E and Form 1040 to calculate Refer to the Form 940 instructions on the IRS website to determine your credit for FUTA taxes. .

Schedule A 940 Form 2024

Source : www.forbes.comForm 940 Instructions (2024 Guide) – Forbes Advisor

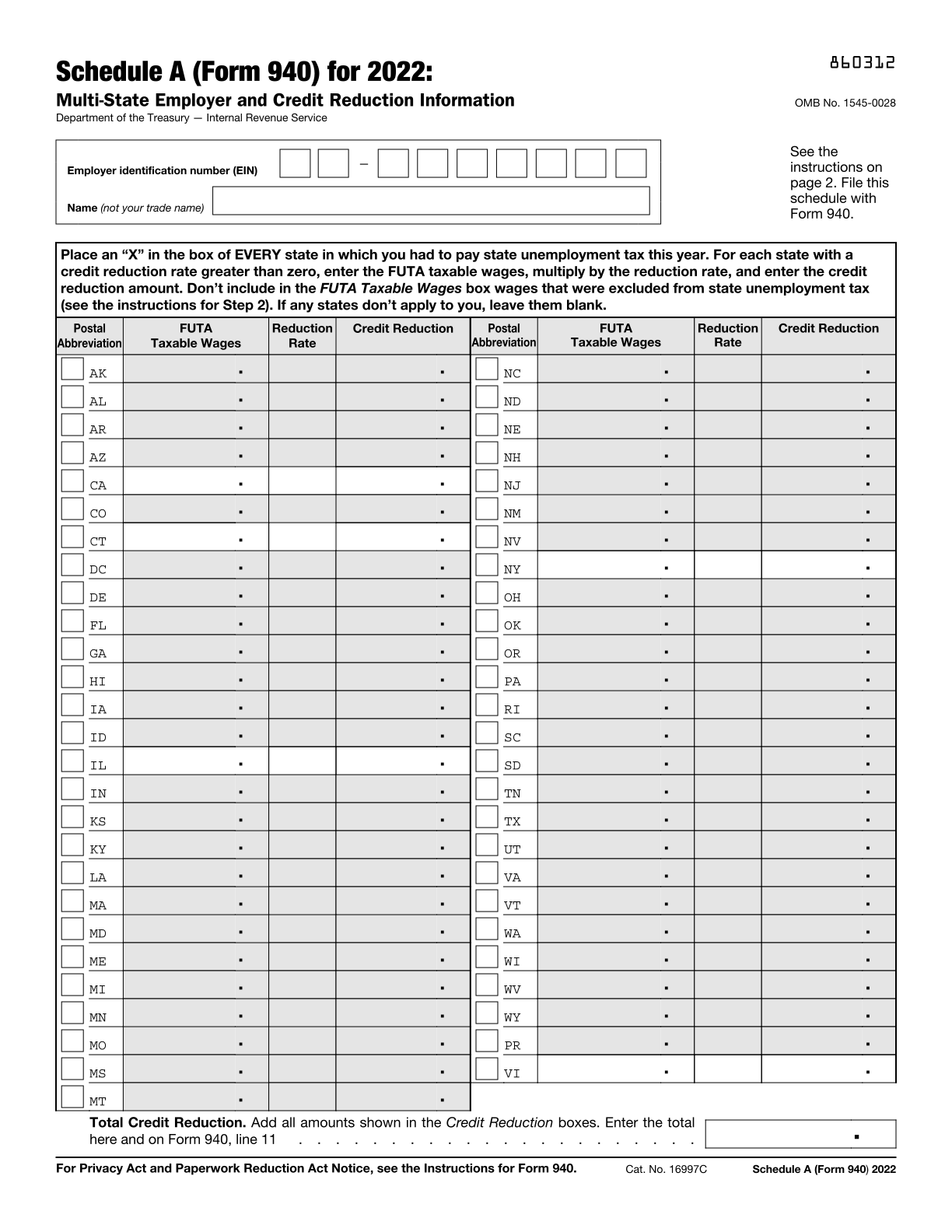

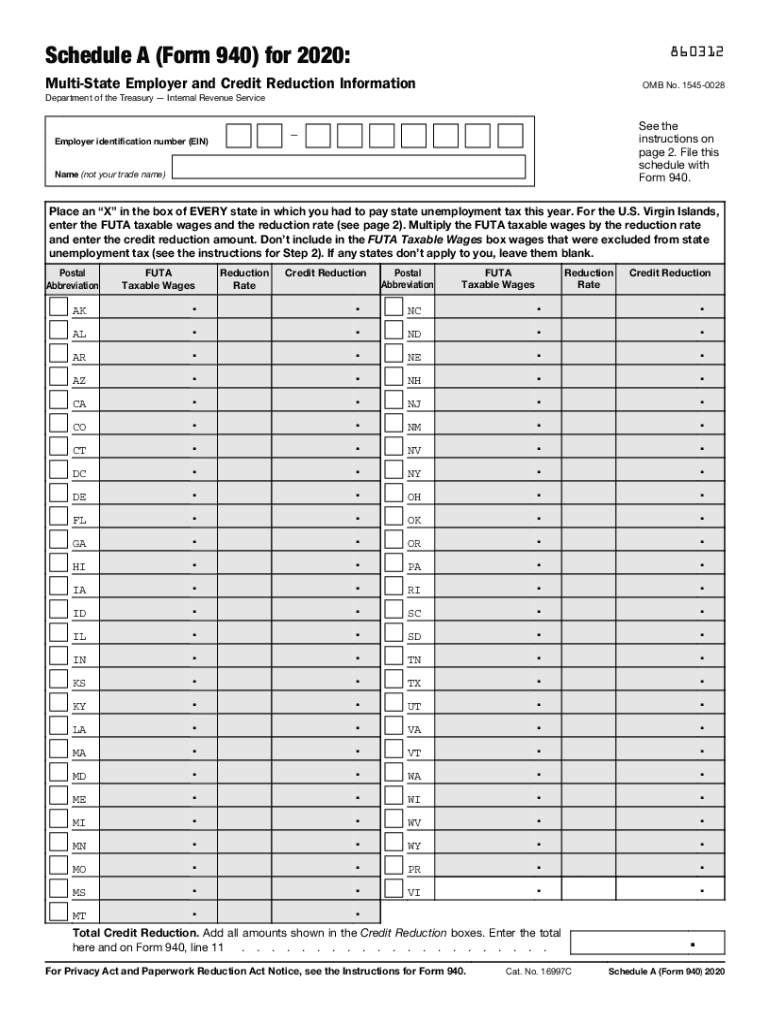

Source : www.forbes.comSchedule A (Form 940) (Multi State Employer and Credit Reduction

Source : hancock.inkAnnual IRS Unemployment Tax Forms Confirm FUTA: Fill out & sign

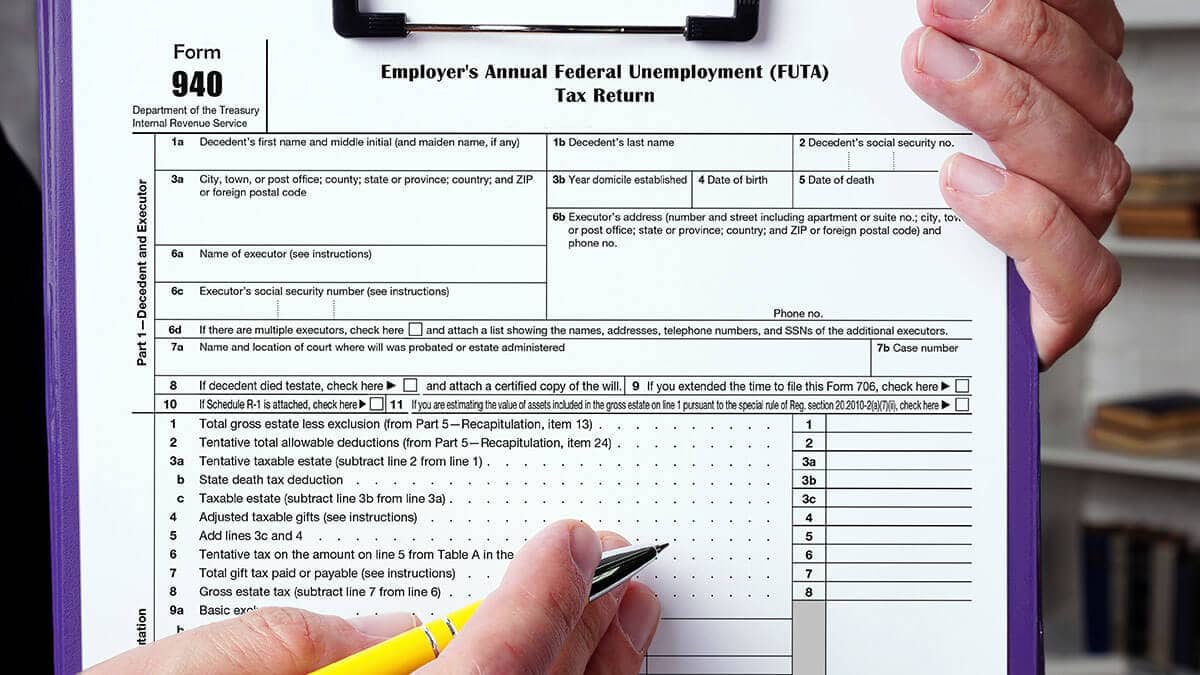

Source : www.dochub.comHow to Fill Out Form 940 | Instructions, Example, & More

Source : www.patriotsoftware.comIrs form 940 schedule a: Fill out & sign online | DocHub

Source : www.dochub.com2024 IRS Form 940: Annual Federal Unemployment BoomTax

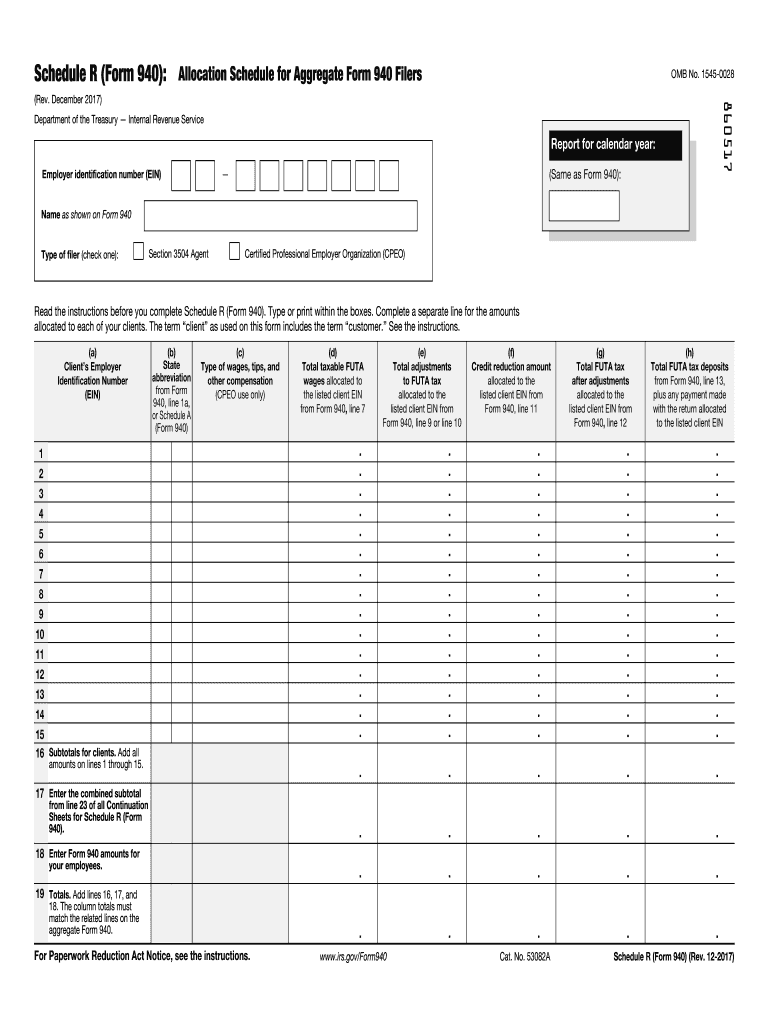

Source : boomtax.com2017 2024 Form IRS 940 Schedule R Fill Online, Printable

Source : r-form.pdffiller.comHere Comes FAFSA | Maryland Business Roundtable for Education

Source : mbrt.org940 form 2023: Fill out & sign online | DocHub

Source : www.dochub.comSchedule A 940 Form 2024 Form 940 Instructions (2024 Guide) – Forbes Advisor: Please review the registration calendar to determine when the form is accepted. This form is provided for: Please select one of the following to proceed to the registration form. Active Login: I am a . Household employers can opt to file and report FUTA taxes using Schedule H via Form 1040 instead of Form 940. Another varying set of requirements exists for agricultural or farming employers. .

]]>